Never forget where you come from!

Since 2008, Juergen Klopp and his team are in charge of the

professional sportive department of Borussia Dortmund. Since then, the club has

been on a steady but unstoppable way, increasing the sportive performance year

for year, ending up as a two times national champion, national cup winner and

the second champions league year in a row. The sportive performance and success

of the squad also put Borussia back on the international stage and

the club attracted more and more international interest, new sympathisers and

supporters. In order to inform our new followers as well as to remember our

existing readers that absolutely

nothing we experience these days and the past years can be taken for granted, this

report will tell the story about the massive management failures in the years

1995 - 2005 that led our football club Borussia Dortmund into a live-threatening

situation with financial debts of over 115 million Euros.

Since 2008, Juergen Klopp and his team are in charge of the

professional sportive department of Borussia Dortmund. Since then, the club has

been on a steady but unstoppable way, increasing the sportive performance year

for year, ending up as a two times national champion, national cup winner and

the second champions league year in a row. The sportive performance and success

of the squad also put Borussia back on the international stage and

the club attracted more and more international interest, new sympathisers and

supporters. In order to inform our new followers as well as to remember our

existing readers that absolutely

nothing we experience these days and the past years can be taken for granted, this

report will tell the story about the massive management failures in the years

1995 - 2005 that led our football club Borussia Dortmund into a live-threatening

situation with financial debts of over 115 million Euros.

During this period, the club “Ballspielverein Borussia 09 e.V. Dortmund” (hereinafter referred to as BVB) was managed via the outsourced company “Borussia Dortmund Geschäftsführungs-GmbH” by lawyer Dr. Gerd Niebaum (hereinafter referred to as Niebaum) the former president of the BVB and management chairman of the company and by Michael Meier (hereinafter referred to as Meier) as the company’s general manager and executive board member. Furthermore, there was the Borussia Dortmund GmbH & Co. KGaA, a public company whose supervisory board had the duty to supervise the actions of Niebaum and Meier, who formed an executive managerial and very homogenous duo with high powers of self-assertion within the company.

The way into the abyss

On the 19th of December 1909 the football club

Ballspielverein Borussia 1909, situated in the heart of the Ruhr Valley in West

Germany, has been founded. In the first decades, the BVB has won three national

championships (1956, 1957 and 1963) until being the first German club ever to

win an international championship in 1966. After hard times following with

financial problems and sportive relegation, the club slowly recovered and came

back to the top by winning the national championship again in 1995 and 1996 and

the UEFA Champions League in 1997.

On the 19th of December 1909 the football club

Ballspielverein Borussia 1909, situated in the heart of the Ruhr Valley in West

Germany, has been founded. In the first decades, the BVB has won three national

championships (1956, 1957 and 1963) until being the first German club ever to

win an international championship in 1966. After hard times following with

financial problems and sportive relegation, the club slowly recovered and came

back to the top by winning the national championship again in 1995 and 1996 and

the UEFA Champions League in 1997.

During the last decades, the BVB has established itself as one of the best clubs in the Bundesliga and is internationally well known. Since foundation, the club could steadily increase its attractiveness and fan base by benefiting from a region, which has been crazy about football. Their stadium “Westfalenstadion”, nowadays know as “Signal Iduna Park” was opened in 1974 with a capacity of 54,000 seats. After several enlargements it is at present the biggest German stadium with a capacity of 81,264 seats and provides the largest standing terrace in Europe with a capacity of 25,000 places. The professionalisation of football clubs did not pass by the BVB. In year 1996, the BVB could benefit from the national and international sportive success and did financially well. The stadium provided constantly over one million spectators per season (since 1999). This ticketing revenues as well as increased income through professionalised marketing and merchandising built the financial basis for the operational business.

As a result, in October 2000 the Borussia Dortmund GmbH & Co KGaA was the first German football business that went public, providing the club with additional funds of 143 million Euros. In addition, the BVB benefited from the economical strong Bundesliga that provided their teams with a stable ticket demand as well as a steady increase of TV, sponsoring and advertising revenues. Moreover, the Bundesliga offered a professional league structure in order to provide high-class competitions. The way that led the BVB closely on the edge of existence was paved by three major topics, the player transfers, the stadium reconstructions as well as the public flotation.

The player transfer politics

Let us first have a look at the initial situation. After 1989, Niebaum managed to transfer five of the best German players from Italy back to Germany by paying unprecedented transfer fees that even the most successful German club FC Bayern Munich could not afford. In the first instance the success proved Niebaum right and the BVB won two national championships and the UEFA Champions League in 1997. In the following years, the sportive success turned the head of Niebaum and Meier and let them think in new dimensions of player fees and wages. The mission statement was clear: sportive success regardless the price.

Within ten

years (1992-2002), Niebaum and Meier managed to invest over 100 million Euros

in players, beating new transfer fee records regularly. Beside Tomas Rosicky

(24 million DM) and Jan Koller (21 million DM), striker Marcio Amoroso,

transferred in 2001 from AC Parma, is still nowadays considered as the most

expensive transfer in the history of the German league with a transfer fee of 21

million Euros. [Meanwhile Javi Martinez became the most expensive transfer in the history of the German league with a transfer fee of 40 million Euros] For this deal in particular, Niebaum and Meier used a non-transparent

finance method that allowed them to veil the real amount of the deal in the

annual balance sheets. Niebaum and Meier were convinced that million transfers would

result in sportive success.

Within ten

years (1992-2002), Niebaum and Meier managed to invest over 100 million Euros

in players, beating new transfer fee records regularly. Beside Tomas Rosicky

(24 million DM) and Jan Koller (21 million DM), striker Marcio Amoroso,

transferred in 2001 from AC Parma, is still nowadays considered as the most

expensive transfer in the history of the German league with a transfer fee of 21

million Euros. [Meanwhile Javi Martinez became the most expensive transfer in the history of the German league with a transfer fee of 40 million Euros] For this deal in particular, Niebaum and Meier used a non-transparent

finance method that allowed them to veil the real amount of the deal in the

annual balance sheets. Niebaum and Meier were convinced that million transfers would

result in sportive success.

After the win of the Champions League in 1997, it was their intended strategy to establish the club at the European top to further compete with international top clubs in the following years. This was only manageable by taking huge financial risks and using the whole amount of available funds. The high-priced team barely won the championship in 2002, but for this success, the management paid a disproportionate high price that could not been carried by the clubs finances on a long-term basis.

The enlargement of the stadium

Since opening in 1974, the Westfalenstadion

has been one of the best and modern stadiums in Europe. In order to obtain these

modern standards, the stadium went through several enlargements and sanitations

for approx. 100 million Euros. However, facing the World Championship in 2006,

the stadium could not compete with the new multifunctional arenas in Germany. The

last possible measure was to extend the corners and further modernise the

stadium. The enlargement of the capacity was essential to become a venue for

the World Championship although it was again a project difficult to finance.

Since opening in 1974, the Westfalenstadion

has been one of the best and modern stadiums in Europe. In order to obtain these

modern standards, the stadium went through several enlargements and sanitations

for approx. 100 million Euros. However, facing the World Championship in 2006,

the stadium could not compete with the new multifunctional arenas in Germany. The

last possible measure was to extend the corners and further modernise the

stadium. The enlargement of the capacity was essential to become a venue for

the World Championship although it was again a project difficult to finance.

Based upon the risky forecast that the BVB will remain one of the European top clubs and that revenues will thereby stay at the same level, Niebaum has been the driving force behind this last stage of enlargement. In fact, the predicted indices showed that this investment could never amortise itself through the increased catering, hospitality and ticketing revenues that the additional seats would provide. Nevertheless, Niebaum wanted the World Championship in Dortmund at any price. The finance for this 31 million Euros project was again adventurous: the club sold 75 % of stadium shares for 75.44 million Euros to the “Molsiris Vermietungsgesellschaft” that was basically a company for property funds. The additional surplus of this deal should moreover financially support the operating business and improve the liquidity.

This method forced the club to

pay rents for 15 years and to buy the stadium back for accumulated costs of 300

million in the estimated time period. After the era Niebaum and Meier, the new club

management reviewed the stadium project as unrealistic ambitious. Again Niebaum

and Meier overestimated the financial burden of this project and acted for

prestige purposes.

This method forced the club to

pay rents for 15 years and to buy the stadium back for accumulated costs of 300

million in the estimated time period. After the era Niebaum and Meier, the new club

management reviewed the stadium project as unrealistic ambitious. Again Niebaum

and Meier overestimated the financial burden of this project and acted for

prestige purposes.

Stock market flotation

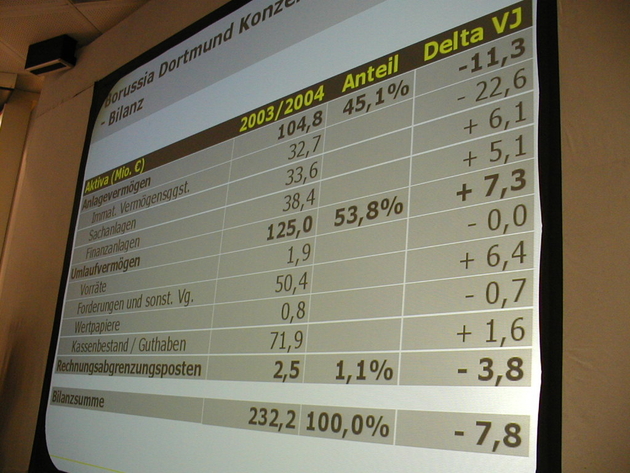

On the 31 October 2000 the BVB went public with a price of 11 Euros per share. 30 football clubs worldwide did this before, 90 % of them failed. In fact, the issue price will never be reached or even topped again. Already before the flotation, investors had a sceptical attitude towards the stock as more and more critical questions about the financial situation and the disastrous management of the club appeared in public. In 2002, Meier officially announced a financial deficit of 9 million Euros, leading into a decrease of the share price to 5,18 Euros until the first general meeting of shareholders in 2002. The fact that Niebaum and Meier already managed to raise the debts of the club to 72 million Euros have been kept secret or at least hidden in the balance sheets.

The flotation provided the club with additional 143 million Euros, being used mostly to redeem debts and finance the expensive team. After a slight recovery in the beginning of 2002, the share dropped to 2,50 Euros as sportive success failed to appear (the team lost the UEFA Cup final in 2002 and further failed to qualify for the UEFA Champions League season 2003/2004) and the financial burden through player wages and stadium enlargement rose dramatically. The share reached its lowest price in year 2005 with 1,85 Euros per share and the debts raising the total debts to 134 million Euros. The clubs equity decreased from 80.8 million in 2004 to 28,5 million Euros in 2004 and rumours about the exclusion of the share from the market circulated.

Niebaum and Meier meanwhile hoped that the

stock market flotation would mark the beginning of a financial consolidation. They

referred to the successful flotation of Manchester United, ignoring the fact

that the British club was just one of a minority of football clubs that operated

successfully as public companies. Due to the deep financial crisis that already

existed, Niebaum and Meier had to work on the edge of legality to hide their

managerial mistakes and beautify the balances. Exemplarily mentioned can be an

issue in 2004 where the management entered the revenues from the next season

ticket sale (10 million Euross) in the balance sheets for the current balance

sheet year. As the last possibility to prevent the club from an economic

collapse, in 2004 Niebaum and Meier established an increase of shares releasing

9.75 million fresh shares for additional 24.3 million Euros. Beneficiary of

this issue was investor Florian Homm, who increased his BVB shares to 25 % and thereby

not only financially rescued the club but also became the major shareholder.

Niebaum and Meier meanwhile hoped that the

stock market flotation would mark the beginning of a financial consolidation. They

referred to the successful flotation of Manchester United, ignoring the fact

that the British club was just one of a minority of football clubs that operated

successfully as public companies. Due to the deep financial crisis that already

existed, Niebaum and Meier had to work on the edge of legality to hide their

managerial mistakes and beautify the balances. Exemplarily mentioned can be an

issue in 2004 where the management entered the revenues from the next season

ticket sale (10 million Euross) in the balance sheets for the current balance

sheet year. As the last possibility to prevent the club from an economic

collapse, in 2004 Niebaum and Meier established an increase of shares releasing

9.75 million fresh shares for additional 24.3 million Euros. Beneficiary of

this issue was investor Florian Homm, who increased his BVB shares to 25 % and thereby

not only financially rescued the club but also became the major shareholder.

However, for this rescue Niebaum and Meier had to pay a high price. Together with Homm they signed a document, granting Homm the possibility to renominate three members for the supervisory board and to force Niebaum to resign. Homm later described the management of Niebaum and Meier as pure dilettantism. In summary, the management failed to administrate the club and to achieve sportive success based on a sound financial basis. Irrational decisions, unrealistic economical forecasts and blind ambition let them to the defiance of fundamental economical rules. The strategy of spending money that has not been earned yet had nearly sealed the fate of the club.

Key assets and key issues

Luckily, the club could always rely on its

strongest asset these days: its loyal supporters. Even in times where sportive

success failed to appear, our club had one of the highest percentage of seats

sold in the league, an essential basis for the operative business of a football

club. The large fan-base resulting from the club’s long tradition furthermore

contributed high value for potential sponsors and investors that could provide

the club with sufficient revenues to stay competitive. The BVB was ranked as

one of the “big three” clubs in the league (besides Bayern Munich and Schalke

04) and thereby received more money from TV revenues, ticketing and sponsoring

as the other 15 competing clubs. However, the business organisation of the BVB was

weakly structured.

Luckily, the club could always rely on its

strongest asset these days: its loyal supporters. Even in times where sportive

success failed to appear, our club had one of the highest percentage of seats

sold in the league, an essential basis for the operative business of a football

club. The large fan-base resulting from the club’s long tradition furthermore

contributed high value for potential sponsors and investors that could provide

the club with sufficient revenues to stay competitive. The BVB was ranked as

one of the “big three” clubs in the league (besides Bayern Munich and Schalke

04) and thereby received more money from TV revenues, ticketing and sponsoring

as the other 15 competing clubs. However, the business organisation of the BVB was

weakly structured.

The supervisory board whose duty was to supervise the actions of the management failed to intervene in the processes that led into the financial disaster. A former member of the board, Dr Winfried Materna, later described the board as too trustful. They did not sufficiently scrutinise the actions of the managing directors. Further, the club had no financial controlling implemented to additionally control the management and to deliver transparency to the stakeholders. Thereby, Niebaum and Meier have been given a nearly free hand in their business practices without sufficient external observation. In the past five seasons (2001 - 2006), Dortmund paid twice the league average to its players. The management invested intensively in the team without achieving sufficient sportive success to amortise these expenditures. As a little hope, the stock market flotation provided several possibilities to further expand the business. The club have raised approx. 143 million Euros through this method.

The win of championship season 2010/2011 let to an upturn. If sportive success remains, the attractiveness for further investments in club shares increases. In the age of globalisation, the BVB further broke into new markets by employing famous players from Brazil or Japan, opening new possibilities to increase TV, marketing and especially merchandising revenues.

The risky phase

In the end of 2005 the operator of the German league, the DFL, had become aware of the clubs crucial situation. Without proving sufficient liquidity, the club was threatened with a withdrawal of the playing licence. This would have let into an enforced relegation and signify the end of competing in professional football. It came all down to the 15th of March 2005, on witch the Molsiris shareholders had to decide if they agree the club the buyback of the stadium. Therefore, they had to renounce to interest payments of several million Euros. Alternatively, they could vote against it, forcing the BVB to go into administration.

This day will always remain in our minds as the one day

where nothing else but the BVB mattered, a day, on which no one could think in

a clear way or even work concentrated. This day, it came all down to a small

group of owners of a real estate fonds with a small voting remote in their

hand, granting them the power to destroy the most pleasing, most emotional,

most important and the most necessary thing of so many of us: our club. Even

current managing director Watzke still nowadays talks fearful about this day

because with his insight in the balance sheets he knew: if too many would push

the red button, the BVB would not be anymore the way we know and love him.

Luckily, the red button was mostly not chosen and the concept of a planned

consolidation was accepted. It delivered the opportunity to recover the club and

simultaneously keeping up the operative business as well as sportive

competition. After the Molsiris shareholders agreed to the new financial and

operative concept, the basis for a strategic financial consolidation to

strengthen the club’s financial situation had been set up.

This day will always remain in our minds as the one day

where nothing else but the BVB mattered, a day, on which no one could think in

a clear way or even work concentrated. This day, it came all down to a small

group of owners of a real estate fonds with a small voting remote in their

hand, granting them the power to destroy the most pleasing, most emotional,

most important and the most necessary thing of so many of us: our club. Even

current managing director Watzke still nowadays talks fearful about this day

because with his insight in the balance sheets he knew: if too many would push

the red button, the BVB would not be anymore the way we know and love him.

Luckily, the red button was mostly not chosen and the concept of a planned

consolidation was accepted. It delivered the opportunity to recover the club and

simultaneously keeping up the operative business as well as sportive

competition. After the Molsiris shareholders agreed to the new financial and

operative concept, the basis for a strategic financial consolidation to

strengthen the club’s financial situation had been set up.

As mentioned in the introduction, the whole region has been crazy about this club that is firmly established in the region of Dortmund. There was simply too much on the line regarding the clubs environment, long tradition and economical importance for the region. A withdrawal from the football business was therefore not possible or imaginable, as it would have an enormous social, cultural and economical effect on the environment. Although the strategy of a financial consolidation was very vulnerable as the club had to rely on its creditors and the consistency regarding their incomes structure, the clubs economical influence and anchorage in the region through its long tradition is too important to let it withdraw the business or go into administration. Essential for the feasibility of the new matters was the resignation of Niebaum and Meier and their replacement through competent managers. The consolidation moreover addressed the most critical problem of the club: the disastrous financial situation. The competitors of the club also welcomed this decision as the BVB plays a central role as a value creator for the league. It could help the club to regain a competitive position in the league and by simultaneously obtaining the economic values. Moreover a consolidation met the shareholder requirements, as they would have lost their whole investment without it.

Re-born!

After Niebaum and Meier were finally forced

to resign, the concept for the consolidation was initiated in 2006. It

contained several measures e.g. the repurchase of the stadium, restructuring of

debts (and thereby detachment of several creditors) as well as the

restructuring of the squad by developing young talents and liquidating

expensive player contracts. Further weaknesses were taken care of: a controlling

department and an external business consultancy had been implemented in order

to make the financial processes more transparent.

After Niebaum and Meier were finally forced

to resign, the concept for the consolidation was initiated in 2006. It

contained several measures e.g. the repurchase of the stadium, restructuring of

debts (and thereby detachment of several creditors) as well as the

restructuring of the squad by developing young talents and liquidating

expensive player contracts. Further weaknesses were taken care of: a controlling

department and an external business consultancy had been implemented in order

to make the financial processes more transparent.

In 2011 the financial consolidation of the club has successfully been implemented. The new management deleveraged 140 million Euros within 5 years and furthermore managed to maintain the competition and achieving sportive success. In season 2010/2011, the BVB once again won the national championship with the youngest team in the history of the club and an average player age of 22.3 years and I don’t have to tell you what happened the year after.

On the last general meeting, the new management declared the consolidation as completed. To the surprise of all shareholders they further hold out the prospect of the first dividend payout in the history of the public company. Having learnt from the failures in the past, the key of the new financial management and the new mission statement of club manager Watzke to remain the competitive advantage was quite simple: maximum sportive success without the use of new debts. Regarding the last decade in the era of Niebaum in Meier, the lack of competences leading to heavy managerial failures was definitely not undeniable. They let themselves run by their absolute willingness to compete with big international clubs such as Barcelona or Bayern Munich and acted irresponsibly with the clubs finances. They furthermore threatened the values and goals of the organisation as sustained sportive success could not be possible without a sound financial basis. In addition, the kind of veiling their methods indicated an ignorant attitude towards the stakeholders. Due to the flotation, the management was forced to work profitable in order to meet shareholder expectations: an impossible task. A flotation under the financial circumstances that surrounded the BVB in 2000 should have never been taken place.

The present situation of the BVB underlines the validity of this consolidation

strategy, as the club did not only manage to fully financially consolidate but

also to return to the highest European competition, the Champions League. After

a decade of mismanagement, Borussia Dortmund is finally back on their way to a

brilliant future. In good times as in bad times, we should always remember where our

club is coming from and which life-threatening period it went through. Let us

not take international matches in the Champions League or even the national competitions for granted; it is a

valuable good for which everyone - club officials, players and supporters -

worked hard for to finally afford it.

The present situation of the BVB underlines the validity of this consolidation

strategy, as the club did not only manage to fully financially consolidate but

also to return to the highest European competition, the Champions League. After

a decade of mismanagement, Borussia Dortmund is finally back on their way to a

brilliant future. In good times as in bad times, we should always remember where our

club is coming from and which life-threatening period it went through. Let us

not take international matches in the Champions League or even the national competitions for granted; it is a

valuable good for which everyone - club officials, players and supporters -

worked hard for to finally afford it.

Our entire life, our entire pride - only BVB!

Humpi 06.10.2012

[[$comments]]

Weitere Artikel